Boracay sunset.

Boracay sunset.

Boracay, Philippines. Overcast and showery but still very peaceful and relaxing.

There is a ton of time and money spent on developing new business and all companies rely on a regular influx of new clients, whatever trade or sector they are in. We should also stay focussed on the rewards that are available from managing the existing relationships we have in place – this is often overlooked and is a very rich source of revenue.

Taking the time to check in with a former customer and see how things are going could be the spark in their mind that it’s time to get moving on that project they had mothballed. The holidays are fast approaching and this is an ideal time to make contact and pick up at the point where your last conversation ended. Go through your order books and contact lists and make the effort to stay in the mind of your clients, however busy you are right now.

And the second set.

First set of photos from last weekend walking in the Peak District, Derbyshire.

It seems that there are a lot more roles available for graduates this year and that’s a really positive sign. The big names are out and pushing hard as they always do – banks, consulting firms, accountancy firms and the usual suspects such as Unilever, P&G, Aldi and the like. But my shout out to graduates would be this: go a bit below the surface and find the really golden opportunities within smaller firms.

In a twitter chat with nu-recruit.co.uk yesterday it turns out they have a fabulous IT role and I’m pushing hard also to fill a couple of jobs for graduates. I ran a presentation at the University of Liverpool yesterday and had three attendees, compared to the PwC session on interview skills in the room next door than had a full house of about 80. I gave the three chaps who turned up to hear me speak as much as I could in terms of advice, guidance and hints to pass the application process and I am certain that the PwC crowd will not have got anything like as much information.

Use the search functions of tools like Twitter and you will see a huge array of opportunities. Make contact with people who you meet through social media, too. I have talked to a lot of graduates at fairs and events this season and am looking forward to one of them connecting with me and having a conversation. Lots of roles are also being advertised only through social channels so get to work and the results might just surprise you.

London lunch spot on a sunny October day.

Sen. Warren Criticizes Washington-Wall Street ‘Revolving Door’

In an exclusive interview Wednesday with Yahoo Global News Anchor Katie Couric, Massachusetts Sen. Elizabeth Warren slammed former House Majority Leader Eric Cantor for accepting a multimillion-dollar job with a Wall Street investment bank shortly after leaving Congress.

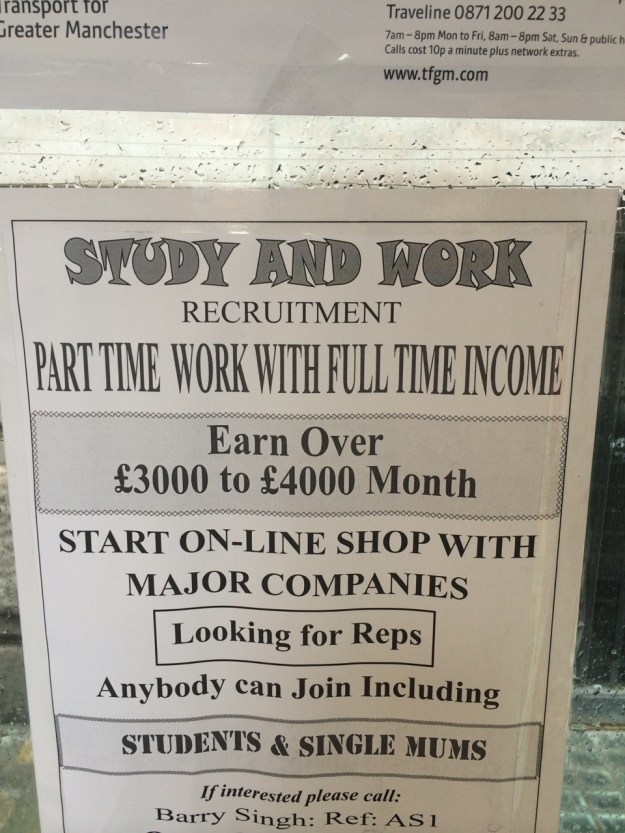

“Anybody can Join…”

Lunch at Saramago Cafe Bar, Glasgow. Lush.

Throws runner out at home on the fly from about 310 feet away in left field.

After muffing Mike Trout’s hit to left field, Yoenis Cespedes seemed on the verge of handing the Oakland Athletics opponent a one-run lead in the bottom of the eighth inning. Trying to take advantage, Howie Kendrick of the Los Angeles Angels raced around third base and appeared a sure bet to cross home plate and break a tie.

That’s when Cespedes uncorked an astonishing throw, from about 310 feet away, that reached the mitt of catcher Derek Norris on the fly — and just in time for him to put the tag on a stunned Kendrick.

Out at the plate!

Wall Street Is About To Start Bleeding

The Wall Street jobs story everyone’s talking about today is in The Wall Street Journal, and it’s ugly.

The gist is this: Get ready for a mass exodus of traders from top Wall Street banks.

It’s not hard to understand why. The market is quiet. As a result, trading — in bonds, credit, currencies, what have you — just isn’t the moneymaker it used to be. People have been warning of this hole in bank balance sheets for months.

Especially in the second quarter, analysts expect trading revenue to nosedive, and it’s key revenue — at Goldman it makes up 30% of their quarterly haul. This deficiency means banks must find a way to cut down unnecessary costs.

Headhunters such as Richard Stein, senior partner at executive-search firm Caldwell Partners, told The Journal that there are “too many people on these trading floors” and that he’s starting to get calls from people who want to jump ship before they’re pushed out.

From The Wall Street Journal:

Mr. Stein of Caldwell Partners says he has received between 17% and 19% more calls in the past month than in the same month a year earlier from managing directors inquiring about job opportunities. Managing directors inhabit the top rung of the Wall Street career ladder.

“It’s very clear to most people that making money and profits is harder,” said a credit trader who left a large U.S. bank earlier this year. “There’s a high probability you’re going to be pushed out. Most people don’t come into a bank thinking they’re going to be there 15 or 20 years, even if they do well.”

Until the market changes — interest rates rise or things become more volatile — traders will be twiddling their thumbs. And Wall Street can’t afford that.

I attended an event this week on conversion/optimisation that really got me thinking about this topic. The talk gave examples of subtle changes applied to web pages that seriously affected engagement, click-through rates and, very importantly in many cases, sales. My thoughts have extrapolated this out into the wider world, not just the one on the screen in front of us or in our hands. The power in getting better information on the decision making of others and understanding the behaviour of people – users, clients, customers, whoever – should never be underestimated.

It doesn’t matter what you do for a living or what market you are in. You might also be in no market at all and just want to find ways to improve your everyday existence. To me, the key here is to listen, learn and collect data, then use it to make better decisions. Way back when social media began the focus was very much on listening to what was going on – who’s saying what on the subjects you care about, who needs help, who are the key thinkers and influencers, etc. The biggest players are now spending mountains of money on this and reaping the rewards by jumping into conversations and unleashing their brand power all over the place, but we can all get better at this and use the results to be better at everything we do. Have better conversations, help people out, show we care, we understand and we give a shit. If it only has a little bit of a positive effect on the life you lead, it’s worth it.

Loggerhead Country Park, near Mold.

A display tracks the path of the planes.

The “Survivor’s Staircase”

A piece of one of the hijacked airplanes brings to life the horror of the attacks. In all, 76 passengers and 11 crew members aboard American Airlines Flight 11, a Boeing 767, perished when the jet crashed…

A bit of The Nightcreatures at Matt and Phreads in Manchester last night. Fabulous.